Maike Futures: Quickly remove the warehouse to support the stability of copper prices

Analyze the current situation of copper prices in the financial market from the macro and spot. Analyzing data from the European Union, the United States and China, the current copper price is relatively stable and the changes are not very large.

Macro

1. The United States announced on Friday that the number of non-agricultural employment was 235,000 in August, compared with 943,000 in the previous month. The unemployment rate was 5.2%, a decrease of 0.2 percentage points from the previous month, and the labor participation rate was 61.7%. The number of employed people is much lower than expected, mainly due to the rebound of the epidemic, and people are unwilling to go out to work. However, starting this week, the residents’ income subsidy program will gradually expire and the epidemic growth has been controlled. It is to see whether the job market will resume growth after September. The employment data was severely weaker than expected, and expectations of shrinking the balance sheet during the year fluctuated again, leading to a fall in US stocks and a sharp drop in the US dollar index on Friday.

2. The inflation data released by the Eurozone last week exceeded expectations. The CPI reached 3%. Some ECB officials proposed to reduce the scale of emergency debt purchases early next year. The European Central Bank meeting this week focused on the central bank’s statement and its impact on the euro exchange rate.

3. Summary: The Fed confirms that the negative effects of the shrinking of the balance sheet and the acceleration of China’s August economic downturn have been realized. However, the financial market’s upward trend may reflect a consensus on the economic rebound in the fourth quarter. The overall economic strength and extremely ample liquidity are still market-leading logic. In the medium term, with the withdrawal of the US stimulus policy, the overall negatives will increase. U.S. employment data was significantly weaker than expected over the weekend, market sentiment was repeated, and domestic demand also needs to be observed to rebound. Financial market sentiment is still fluctuating repeatedly.

Spot goods

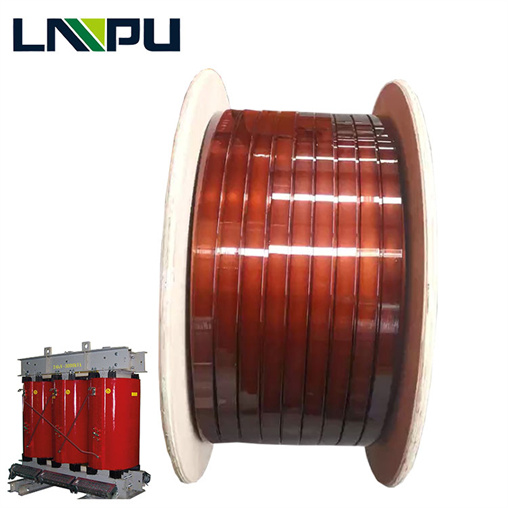

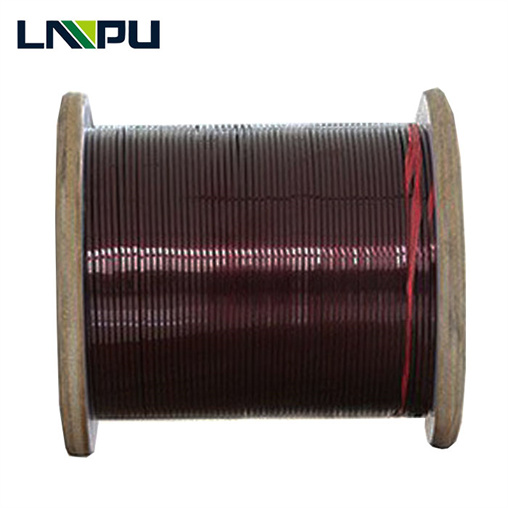

1. According to SMM data, as of Friday, the domestic social stock of electrolytic copper was 131,000 tons, a decrease of 3 million tons from last week, and the bonded stock was 347,000 tons, a decrease of 40,000 tons from last week. Due to early import profits, import customs clearance continued last week. Due to the continuous interference in the production and import of refined copper and copper scrap, consumption has been flat but actually maintained a relatively rapid rate of reduction in storage. As the peak season approaches, the marginal support of low inventories on copper prices has further strengthened.

2. Affected by the closing of the import window, LME cancellation warehouses stopped increasing last week, and the total cancelled warehouse receipts remained at nearly 100,000 tons, accounting for 39%, and the available inventory in Asia was extremely low. Imports resumed profitability on Thursday and Friday. It is estimated that the continuous rapid decline in domestic inventories will keep the price ratio at a small profitability level, which will help LME inventories continue to decrease. The large-scale cancellation of warehouse receipts has increased the confidence of overseas holders to do more, and the upward rhythm of copper prices has become more brisk.

3. Recently, a number of energy-consumption double-row excess areas have successively implemented emission reductions and production restrictions, and Guangxi’s electricity curtailment has increased, and copper smelter interference is still expected to be strong. According to SMM research, in September, Guangxi refinery maintenance continued to affect production. In addition to the shortage of copper scrap supply, some refineries began to lose money in processing fees, and the increase in refined copper production continued to be limited in September.

4. Copper prices dropped slightly last week. In addition, corporate purchases have recovered after the month change, but overall consumption has not rebounded. After a large number of low-level replenishments, the buying interest of the downstream has greatly reduced. According to SMM statistics, the operating rate of copper rods has also fallen from the previous month. . However, the spot premium on the following month re-expanded over the weekend, spot imports saw a meager profit again, and scrap copper holders reluctant to sell when the price fell, and the overall price structure remained strong. Pay attention to the recovery of consumption in the peak season. Before the low inventory and the consumption peak season has not been falsified, copper prices still have strong support.

5. Summary: The overall macro logic is bullish. The focus of the copper market has shifted to spot supply. Due to the concentration of various supply disturbances, the copper market has continued to rapidly destock. Under low copper, copper prices have fallen slightly and the premium structure has been strengthened, and price support has been significantly enhanced. The gradual recovery of consumption during the peak season is expected to support the upward fluctuation of copper prices. Strong support area below 68500, the idea of buying on dips remains unchanged. Today 69500-68800